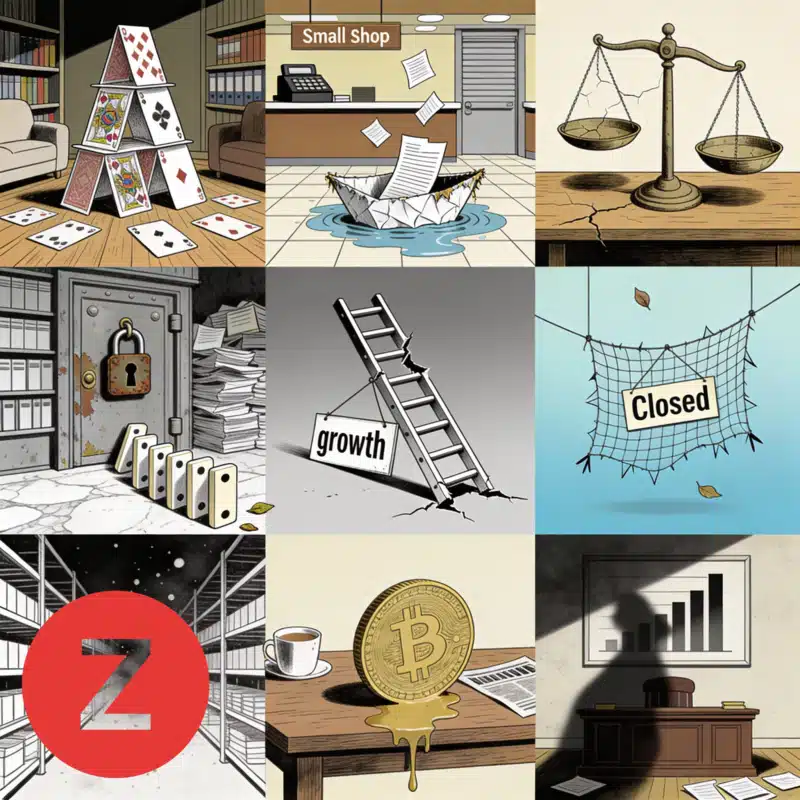

Good Debt vs Bad Debt

Debt keeps 64% of Americans up at night according to American Psychological Association research. Total household debt has surpassed $17 trillion nationwide.

But not all debt deserves equal worry or treatment. Some borrowing builds wealth over time while other borrowing destroys financial futures. Understanding the difference changes everything.

This guide explains which types of borrowing help your financial future and which types hurt it badly, plus strategies for managing both effectively.

Debt keeps 64% of Americans up at night according to American Psychological Association research. Total household debt has surpassed $17 trillion nationwide.

But not all debt deserves equal worry or treatment. Some borrowing builds wealth over time while other borrowing destroys financial futures. Understanding the difference changes everything.

This guide explains which types of borrowing help your financial future and which types hurt it badly, plus strategies for managing both effectively.

Understanding Debt-to-Income Ratio

Calculate your debt-to-income ratio by dividing total monthly debt payments by gross monthly income. This single number reveals tremendous amounts about your financial health.

Example: $2,000 in monthly debt payments divided by $4,500 gross income equals 44%. Most financial experts consider anything above 43% problematic.

Lenders use debt-to-income ratios to assess borrower risk carefully. Ratios above 43% typically disqualify mortgage applicants and indicate strain on household finances.

The 28/36 rule suggests housing costs should stay below 28% of gross income and total debt payments below 36%. Exceeding these thresholds indicates financial stress requiring attention.

Calculate your ratio monthly and track trends over time. Rising ratios despite stable income indicate spending or debt problems requiring immediate intervention.

Warning Signs of Excessive Debt

Paying only minimum payments on credit cards while balances grow signals serious trouble. Minimum payments barely cover interest charges, leaving principal essentially untouched.

Using credit cards for necessities like groceries and utilities because cash runs out indicates income-expense imbalance requiring immediate attention and budget changes.

Hiding spending from family members suggests awareness that spending exceeds reasonable limits. Secrecy prevents partnership in solving financial problems together.

Constant financial anxiety affecting sleep, relationships, and work performance demands action. Debt stress syndrome causes real physical and mental health consequences.

Receiving collection calls or letters, having accounts sent to collections, or facing legal threats for unpaid debts indicates crisis requiring professional intervention.

What Makes Debt Good?

Good debt increases net worth or generates future income exceeding interest costs over time. The borrowed money produces returns justifying and exceeding borrowing expenses.

Good debt typically carries lower interest rates reflecting lower lender risk. Secured debt backed by valuable collateral commands better terms than unsecured borrowing.

Tax advantages often accompany good debt. Mortgage interest and student loan interest provide tax deductions reducing true borrowing costs further.

Good debt finances assets with long useful lives matching or exceeding repayment periods. You enjoy benefits throughout the entire time you're paying.

Mortgages: The Classic Good Debt

Mortgages represent the classic textbook example of good debt. Real estate appreciates historically while you simultaneously build equity with each monthly payment.

A home purchased for $250,000 appreciating 3% annually reaches $485,000 value when a 30-year mortgage is fully paid off. At 4% appreciation, value exceeds $649,000.

Mortgage interest rates remain among the lowest available for any type of borrowing. Current rates, while higher than recent historic lows, still represent relatively cheap money.

Mortgage interest tax deductions reduce effective borrowing costs further for taxpayers who itemize. A portion of interest payments essentially comes back at tax time.

Forced savings through required principal payments build wealth automatically even for those who struggle to save voluntarily through other methods.

Student Loans: Usually Good Debt

Student loans can represent good debt when the resulting education substantially increases earning potential. A nursing degree costing $50,000 leading to $70,000+ annual salary justifies borrowing.

Bachelor's degree holders earn approximately $1.2 million more over their careers than high school graduates on average. The earnings premium typically exceeds borrowing costs.

Federal student loans offer income-driven repayment plans and forgiveness options reducing repayment risk. Flexible terms help borrowers manage regardless of initial salary outcomes.

However, borrowing $100,000 for a degree with only $40,000 earning potential creates bad debt regardless of asset category. Research career outcomes thoroughly before borrowing.

Home Equity for Improvements

Home equity loans used for value-adding improvements qualify as good debt. New kitchens, bathrooms, and structural improvements often return 70-80% of costs in increased home value.

Energy efficiency improvements reduce ongoing utility costs while increasing property value. Solar panels, insulation upgrades, and efficient HVAC systems pay dividends for years.

Home equity rates remain significantly lower than unsecured alternatives. Using equity to finance improvements beats credit card financing for identical projects.

Caution: home equity loans put your house at direct risk. Failure to repay can result in foreclosure regardless of what funded the original loan.

What Makes Debt Bad?

Bad debt finances consumption of items losing value immediately upon purchase. Interest paid adds to total costs of things already worth less than you paid.

Bad debt typically carries high interest rates reflecting higher lender risk and shorter payback expectations. Unsecured consumer debt commands premium rates.

No tax advantages accompany bad debt whatsoever. Interest paid on credit cards, auto loans, and personal loans provides no deductions or credits.

Bad debt finances short-lived purchases with repayment periods exceeding useful life. You're still paying for last year's vacation while planning the next one.

Credit Card Debt: Often the Worst

Credit card balances carried month to month represent the most common and often most damaging form of bad debt. Average APRs exceed 20% on most cards currently.

A $5,000 credit card balance at 20% interest paying only minimums takes 17 years to eliminate and costs over $6,000 in interest charges alone.

The convenience of credit cards enables spending beyond means without immediate visible consequences. Monthly statements arrive long after purchase excitement fades completely.

Promotional 0% interest purchases become extremely expensive when promotional periods end and deferred interest charges apply retroactively to original full balances.

Store credit cards often carry even higher rates than general purpose cards while offering minimal rewards. The instant discount rarely justifies the ongoing cost.

Auto Loans: Complicated Territory

Auto loans occupy complicated middle ground between good and bad debt. A modest reliable vehicle enabling employment creates real value potentially justifying borrowing costs.

However, new cars lose 20-30% of value immediately driving off the dealer lot. A $35,000 car becomes worth $28,000 instantly while you owe the full amount.

Long loan terms (72-84 months) keep payments artificially affordable but extend underwater periods where loan balances exceed vehicle values. Accidents create financial crises.

Better approach: buy slightly used vehicles with lower prices and slower depreciation rates. Three-year-old cars often represent optimal value for most buyers.

Payday Loans: Always Bad

Payday loans charge astronomical rates equivalent to 400%+ APR. A $500 loan might cost $575 to repay in just two weeks, trapping borrowers in inescapable cycles.

The payday loan business model depends entirely on borrowers being unable to repay, forcing loan renewals with additional fees compounding each cycle.

Alternatives exist for emergency cash needs: credit union payday alternative loans, payment plans with creditors, community assistance programs, and even credit card advances cost less.

Converting Bad Debt to Better Debt

Balance transfer cards offer 0% introductory rates for 12-21 months. Transfer high-interest credit card balances and pay aggressively during promotional periods.

Personal loans at 10-15% APR beat credit card rates of 20-25% significantly. Consolidate multiple high-interest debts into single lower-interest fixed payments.

Home equity loans at 7-9% can pay off 20%+ credit card debt providing substantial interest savings. But understand the risk: your home now secures this debt.

Debt management programs through nonprofit credit counseling agencies negotiate reduced interest rates with creditors, often cutting rates by half or more.

FAQ

Is my mortgage always good debt?

Generally yes if you can genuinely afford payments and the home appreciates. Overbuying creates bad debt regardless of asset type.

Are student loans always good debt?

No. Borrowing must align with realistic earning potential. Research career outcomes thoroughly before committing to significant education debt.

Should I pay off all debt completely?

Not necessarily. Low-interest debt under 5% might be worth keeping if investments earn more. High-interest debt should go immediately.

Is a car loan always bad debt?

Not always. A modest reliable car enabling employment creates value. Borrowing for luxury vehicles beyond actual needs creates bad debt.

How should I prioritize debt payoff?

Attack highest interest rates first mathematically (avalanche method) or smallest balances first psychologically (snowball method).

When should I seek professional help?

If minimum payments consume over 20% of income or you cannot see a realistic path to debt freedom within five years.

Understanding these principles helps make informed financial decisions protecting long-term stability through proven strategies and consistent application.

Professional guidance provides valuable perspective when navigating complex situations preventing costly mistakes through specialized knowledge and experience.

Each situation requires personalized strategies rather than one-size-fits-all solutions based on individual circumstances and unique financial goals.

Taking action today creates better outcomes than waiting for perfect conditions through small consistent steps that accumulate over time.

Financial literacy represents one of the most valuable skills anyone can develop through knowledge that pays dividends for decades.

Updated 2026-01-17