How Long Does Bankruptcy Take Once Filed

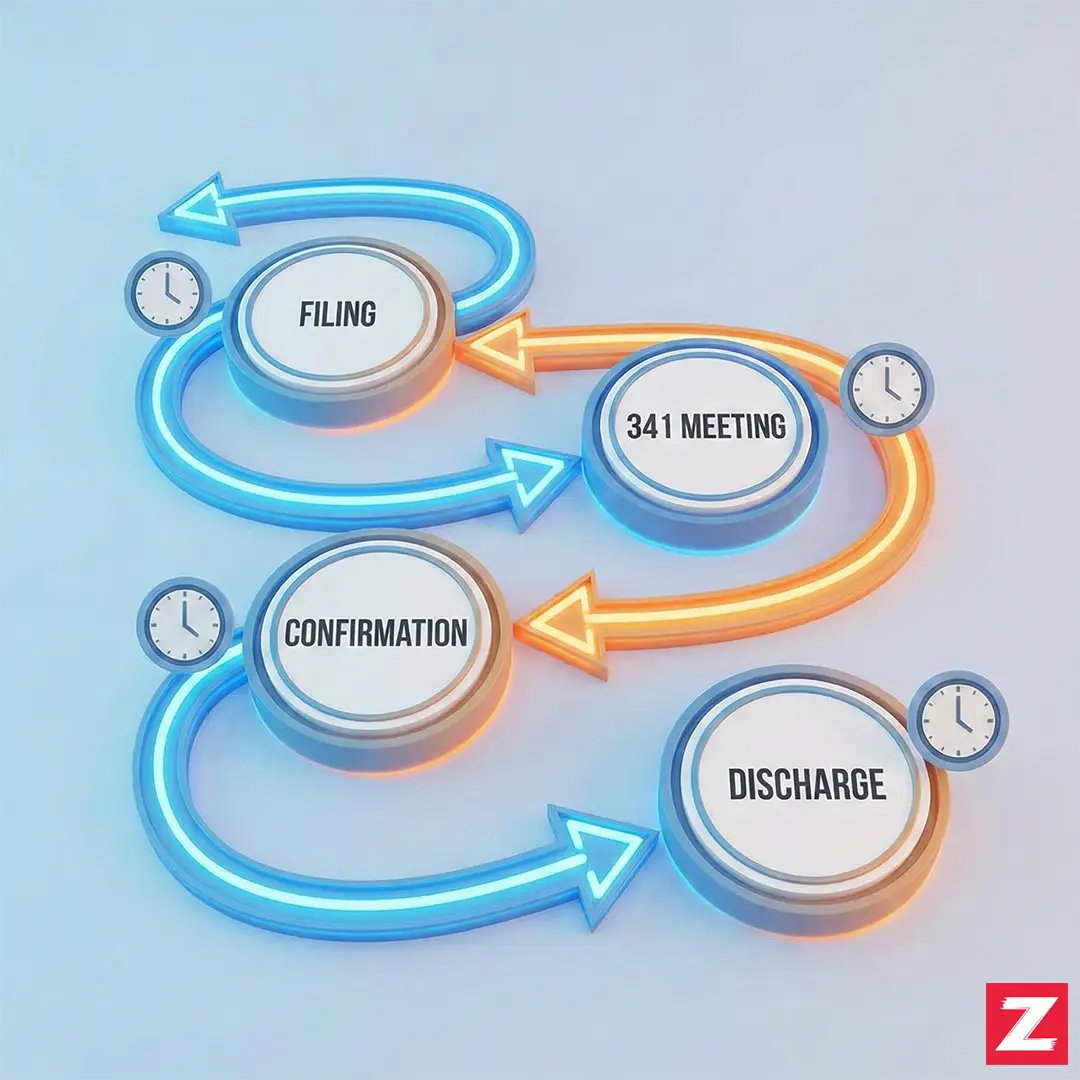

The timeline depends entirely on which chapter you file. Chapter 7 moves fast—expect three to four months from filing to discharge. Chapter 13 is a marathon, lasting three to five years by design.

That's the simple answer. The actual experience involves specific deadlines, potential complications, and waiting periods you should understand before filing.

Bankruptcy Timeline Comparison

| Milestone | Chapter 7 Timeline | Chapter 13 Timeline |

|---|---|---|

| Automatic Stay Begins | Immediately | Immediately |

| 341 Meeting Scheduled | 30-45 days | 30-45 days |

| Creditor Claims Deadline | 70 days after 341 | 90 days after 341 |

| Plan Confirmation | N/A | 30-45 days after 341 |

| Discharge Granted | 60 days after 341 | After completing 3-5 year plan |

Day One: The Automatic Stay

The moment your attorney files the bankruptcy petition electronically, protection kicks in. The automatic stay stops all collection activity instantly. Creditors must cease calling, stop lawsuits, halt garnishments, and postpone foreclosures.

Within days, you'll receive a case number and assignment to a trustee. Your creditors receive notice of filing, usually within a week. This first week brings the most dramatic change—phones stop ringing, threatened lawsuits become moot.

Expert insight: "If a creditor contacts you after you've filed, document it. Stay violations can result in damages awarded to you."

The 341 Meeting: Weeks 4-6

About a month after filing, you attend the Meeting of Creditors. Despite the name, creditors rarely appear. The trustee asks questions about your petition, verifies your identity, and confirms honesty about assets and debts.

Most 341 meetings last 5 to 15 minutes. The trustee has a stack of cases that day and isn't looking for trouble—they're checking boxes. Answer honestly, provide any requested documents, and the meeting usually passes without incident.

Chapter 7: The Sprint to Discharge

After your 341 meeting, Chapter 7 becomes a waiting game. Creditors have 60 days to object to discharge or challenge specific debts. The trustee investigates whether non-exempt assets exist for liquidation. Both deadlines run simultaneously.

In no-asset cases—95% of consumer Chapter 7 filings—the trustee files a report of no distribution. There's nothing to liquidate. Creditors who don't object let their deadline pass. The court issues discharge around day 60 after the 341 meeting.

| Chapter 7 Event | Timeline |

|---|---|

| Filing | Day 0 |

| Automatic stay begins | Day 0 |

| 341 meeting | Day 30-45 |

| Creditor objection deadline | Day 90-105 |

| Discharge issued | Day 90-120 |

| Case closed | Day 100-140 |

Chapter 13: The Long Road

Chapter 13 bankruptcy is fundamentally different. You're not liquidating assets—you're reorganizing debt and paying creditors from income over three to five years. The discharge comes only after successfully completing your payment plan.

Once confirmed, you make monthly payments to the trustee for the duration of your plan. Three years if income is below state median. Five years if above. Every month. No exceptions.

Expert insight: "Set up automatic payments for your Chapter 13 plan. Manual payments create opportunities for missed deadlines that can derail your entire case."

Factors That Extend Timelines

Several complications can stretch bankruptcy duration. Adversary proceedings—separate lawsuits within bankruptcy—add months or years. These typically involve fraud allegations or preference payment challenges.

Asset liquidation in Chapter 7 takes time. If the trustee identifies non-exempt property, they must appraise, market, sell, and distribute proceeds. Creditor objections require hearings. Even frivolous objections cause delays.

Managing Expectations

People often underestimate emotional timelines more than legal ones. The relief of filing gives way to waiting. Even Chapter 7's fast track feels slow when you're living it. Stay focused on progress markers.

Frequently Asked Questions

Can I speed up Chapter 7?

Generally no—court schedules and statutory deadlines control timing regardless of document speed.

What happens if I miss a Chapter 13 payment?

One missed payment usually gets excused with quick cure; repeated misses risk dismissal.

How long until I can buy a house?

FHA loans available 2 years after discharge; conventional loans require 4 years.

Does the 341 meeting happen in a courtroom?

No—it's typically held in a conference room at the trustee's office.

Can Chapter 13 take less than 3 years?

Sometimes—below-median income debtors may propose shorter plans if paying claims in full.

When does bankruptcy stop showing on credit reports?

Chapter 7 remains 10 years, Chapter 13 remains 7 years from filing.

Updated 2025-01-07